Understanding Loss in Trading & How to Recover

Learn about loss in trading, how to recover, and the best course for trading. Discover insights to choose the best stock market course for you.

Understanding Losses in the Stock Market: A Friendly Guide for Every Investor

Introduction

Have you ever stared at your stock portfolio and felt your heart sink? Youre not alone. Losses in the stock market are like surprise stormssometimes small, sometimes overwhelmingbut they come for everyone, from newbies to seasoned traders. The key isnt to avoid them altogether (because lets be real, thats impossible), but to understand why losses happen and how to bounce back stronger.

In this guide, well simplify everythingfrom why losses occur to how to manage them, and even how enrolling in the best stock market course can turn your setbacks into comebacks. So if youve experienced loss in trading or want to avoid major pitfalls, keep reading. Were diving in with plain language, relatable examples, and zero fluff.

Learn about loss in trading, how to recover, and the best course for trading. Discover insights to choose the best stock market course for you.

What Is Loss in Trading?

Loss in trading simply means that you bought a stock (or any asset) at a certain price and sold it at a lower price. That difference? Thats your loss.

Its like buying a new phone for ?30,000 and later realizing it's only worth ?20,000 now. That ?10,000 drop is your loss. Simple, right?

But in the stock market, these losses can be quick, sudden, and painfulespecially without a clear plan.

Why Do Most Traders Lose Money?

Heres a truth pill: more than 90% of retail traders lose money.

Why? Mostly due to:

-

Lack of knowledge

-

Emotional decisions

-

Poor planning

-

Unrealistic expectations

Many jump in without understanding how markets work. Its like driving a car blindfoldedyoure bound to crash.

Emotional Impact of Trading Losses

Lets face it, losing money hurts. The emotions are real:

-

Fear: What if I lose more?

-

Anger: Why didnt I sell earlier?

-

Guilt: I shouldve known better.

These feelings often lead to revenge tradingtrying to win it all back in one shot. Big mistake. Losses mess with your head more than your wallet.

Types of Losses in the Stock Market

Not all losses are created equal. Understanding their types helps you manage them:

-

Realized Loss: You sold a losing stockloss confirmed.

-

Unrealized Loss: Youre still holding a stock thats down.

-

Stop-loss Triggered: Your safety net kicked in.

-

Panic Sell: Emotional exit without a plan.

Each type teaches a lesson. Real traders reflect and learn from them.

Common Trading Mistakes to Avoid

You know that feeling when you make a silly mistake and then say, I knew better? In trading, those mistakes can be costly:

-

Overtrading: Too many trades, too little strategy.

-

Ignoring stop-loss: You dont exit and watch your losses grow.

-

Following tips blindly: If it sounds too good, it probably is.

-

No backtesting: You try strategies youve never practiced.

Avoid these, and youve already won half the battle.

Understanding Risk vs. Reward

Think of trading like walking a tightrope with a safety net.

The reward is reaching the other side (profit), and the risk is falling (loss). Your job? Make sure your net (risk management) is strong enough so even if you fall, you survive to walk again.

Role of Psychology in Trading Losses

Trading isnt just numbers and chartsits 80% mindset.

-

Greed makes you hold too long.

-

Fear makes you exit too early.

-

Ego makes you ignore warnings.

Want to win? Train your brain as much as your strategies. Most loss in trading happens because people battle the market instead of mastering themselves.

How to Recover from Trading Losses

Lost money? Take a breath. Heres how to recover:

-

Step back: Dont trade emotionally.

-

Review your trades: Find patterns in your mistakes.

-

Set realistic goals: Dont aim to recover all in one go.

-

Educate yourself: A good course for trading can be a game-changer.

Losses hurt, but theyre not the endjust a detour on your trading journey.

Importance of a Trading Plan

Would you build a house without a blueprint? Of course not. Trading without a plan is equally risky.

A good trading plan includes:

-

Entry and exit points

-

Risk-reward ratio

-

Stop-loss levels

-

Strategy rules

Stick to the plan. Dont let emotions hijack your trades.

Power of Learning: Course for Trading

Still struggling to make consistent profits? Maybe its time to learn properly.

A course for trading provides:

-

Structured learning

-

Proven strategies

-

Mentorship and support

-

Real-time case studies

Its like upgrading from riding a bicycle with training wheels to a geared bikeyou gain control and speed.

What Makes the Best Stock Market Course?

Not all courses are created equal. The best stock market course should offer:

-

Beginner to advanced modules

-

Live trading sessions

-

Clear explanations without jargon

-

Practical assignments

-

Supportive community

Look for credibility, reviews, and how updated the content is. Your learning should evolve with the market.

Technical vs. Fundamental Mistakes

Technical errors come from charts, indicators, and signals.

Fundamental errors involve ignoring the companys earnings, management, or industry news.

Balancing both helps you avoid mistakes like buying a stock because the chart looks good, while ignoring the fact that the company is near bankruptcy.

Risk Management Strategies

Want to stay in the game long enough to win? Manage your risk like a pro:

-

Use stop-loss orders

-

Dont risk more than 2% per trade

-

Diversify your portfolio

-

Set clear profit targets

Risk management is like wearing a helmetyou may not always need it, but when you do, youll be glad its there.

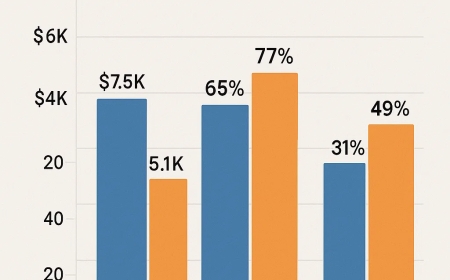

Real-Life Examples of Trading Losses

Even legends face losses. Take Rakesh Jhunjhunwalahe lost big on a few calls. But he never stopped learning or adapting.

Or the 2020 market crash, where even savvy traders saw portfolios bleed. The lesson? Losses are part of the game; its how you respond that defines your journey.

Turning Losses into Learning

Heres the secret: Every loss is a hidden teacher.

When you analyze what went wrong, when you tweak your strategy, when you finally say, Okay, I wont repeat this again, thats when growth happens.

Losses dont mean failure. They mean feedback.

Conclusion

Losses in the stock market are inevitable, but they dont have to be devastating. Think of them like growing pains. They hurt, yes, but they help you become a smarter, wiser, and more confident trader. The real tragedy isnt the loss in tradingits not learning from it.

Whether you're just starting out or licking your wounds from recent losses, remember: every expert was once a beginner. And the difference between giving up and getting better often lies in education. So if you're serious about leveling up, consider investing in the best stock market course or a solid course for trading. Your future self will thank you.

Frequently Asked Questions (FAQs)

1. What is the main reason for loss in trading?

The main reason is a lack of proper knowledge, emotional decisions, and trading without a solid plan or risk management strategy.

2. How can I avoid emotional trading mistakes?

By following a structured plan, setting stop-losses, and keeping emotions like fear and greed in check. Courses can also help you develop discipline.

3. Are losses in the stock market always bad?

No. Losses are learning opportunities. They help you improve your strategy and understand the market better if you analyze and learn from them.

4. Is taking a course for trading really helpful?

Absolutely! A good trading course teaches you strategies, risk management, and market psychology, giving you a better chance at long-term success.

5. How do I find the best stock market course?

Look for courses with real-world application, updated content, experienced mentors, and positive reviews. Choose one that matches your skill level and goals.

&srotate=0)